In compliance with 2021 UK VAT treatment, as an online marketplace, SaleYee will collect VAT (20%) for products delivered from the UK warehouse at the point of checkout. It means that all users selling goods in the UK are legally required to submit the related information on saleyee.com to ensure placing orders normally. In response to this, the SaleYee platform has launched the related function for Non-VAT-registered users to submit the personal ID information, while for VAT-registered users to submit VAT ID numbers and other information as required. In this article, we will introduce the step-by-step guide.

Contents

- Part 1: Related Information List

- Part 2: Guidelines for VAT-Registered Users

- Part 3: Guidelines for Non-VAT-registered users

- Part 4: Guidelines for Different Methods on Placing Orders

- Part 5: FAQs

1. Related Information List

|

VAT-registered user |

Non-VAT-registered user |

|

Company name |

Bill-to party |

|

VAT ID number |

Country |

|

Country of incorporation |

Address |

|

Company registration address |

Certificate type |

|

Business license/business registration certificate |

ID number |

|

VAT certificate |

Identity photo |

|

Store name |

Commitment letter confirmation |

|

Store URL |

/ |

|

Screenshot of your seller account |

/ |

|

Commitment letter confirmation |

/ |

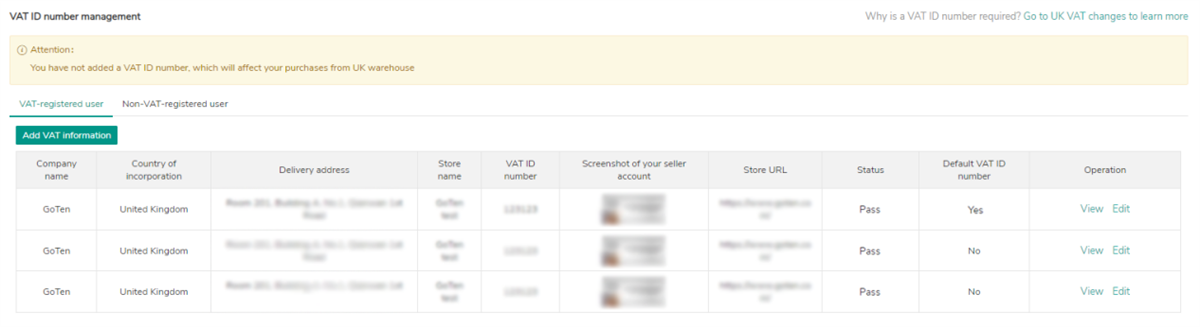

VAT-registered users can add multiple VAT ID numbers, and can set the default VAT ID number. When placing an order via API, the system will automatically sync to the default VAT ID number. Non-VAT-registered users can change into VAT-registered users after successfully registering VAT ID number.

Please ensure the information provided true and valid for the SaleYee platform to verify. After approval, orders can be placed normally. Otherwise, you need to submit relevant information again.

2. Guidelines for VAT-Registered Users

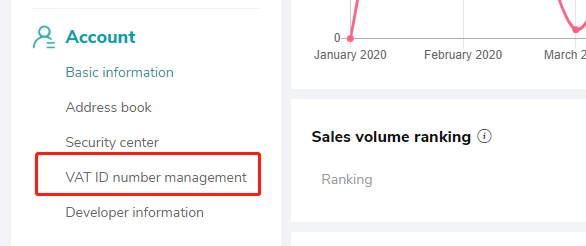

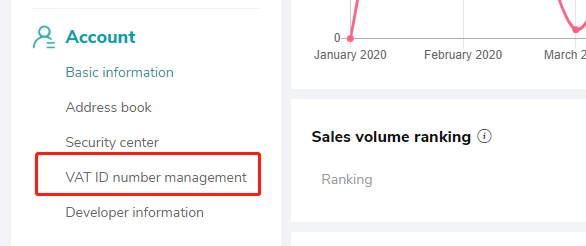

(1) Go to “My SaleYee”- “Account”- “VAT ID number management”

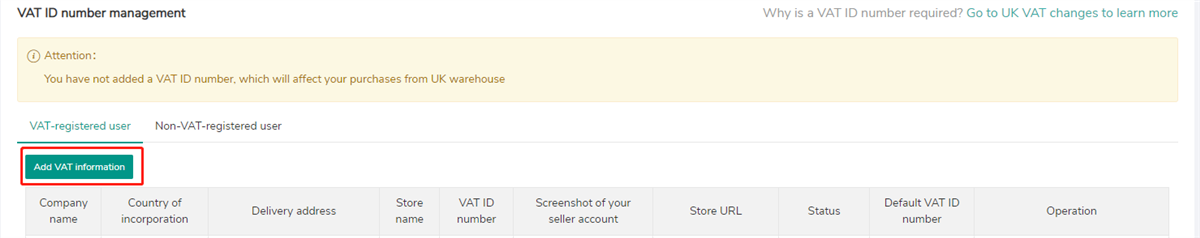

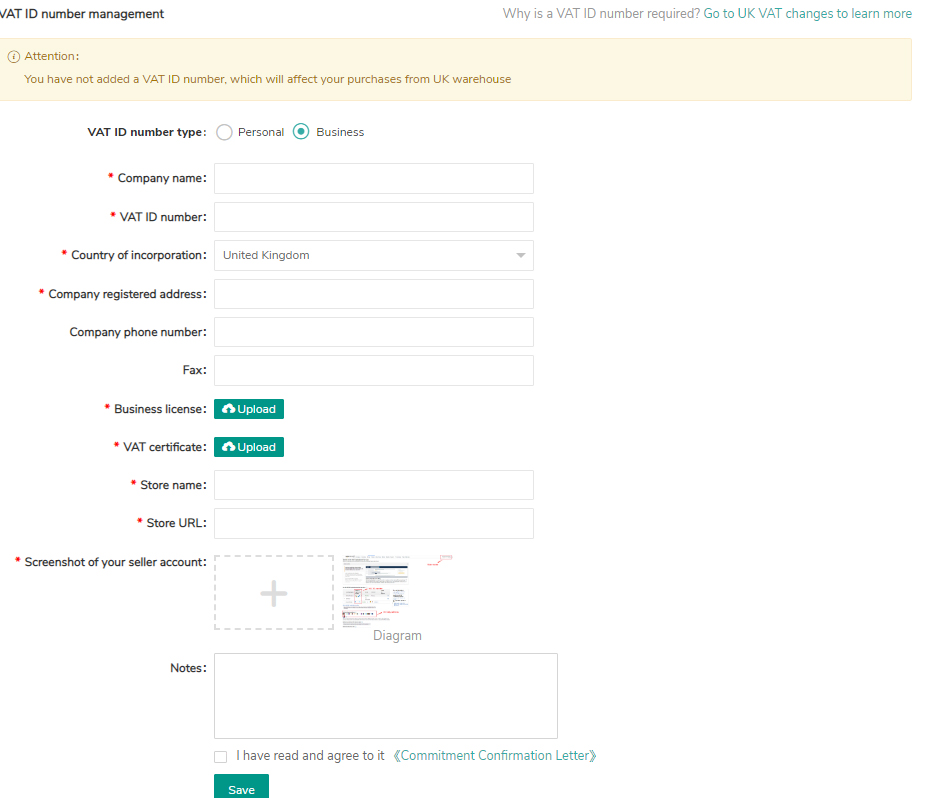

(2) Click “VAT-registered user” - “Add VAT information” to fill in related information

After clicking "Save", you can find the information you've just submitted "Pending Approval" under the tab of "VAT-registered user." Please wait for the approval.

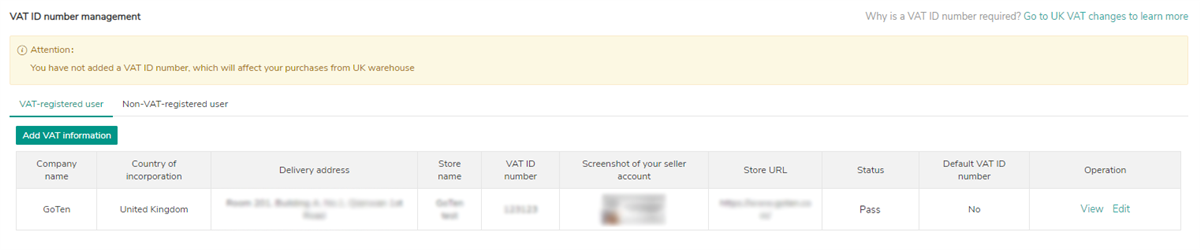

(3) There are three verification statuses: Pass, Fail, Pending verification. After your VAT information is verified, you can find the "Status" shown as "Pass." If the status shows "Fail," you need to "Edit" and submit the information again.

(4) After verification, you can set the default VAT ID number. (The default VAT ID number is required for placing orders via API.)

(5) On this page, you are also allowed to add more VAT information by clicking the button, "Add VAT information."

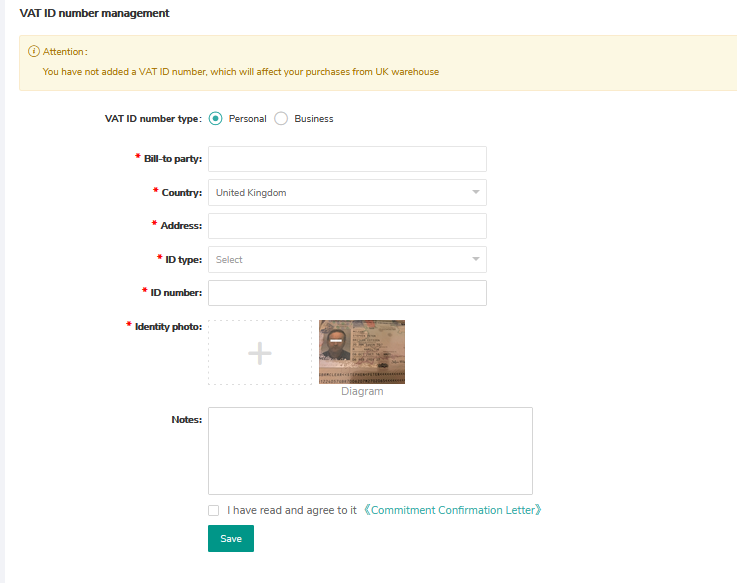

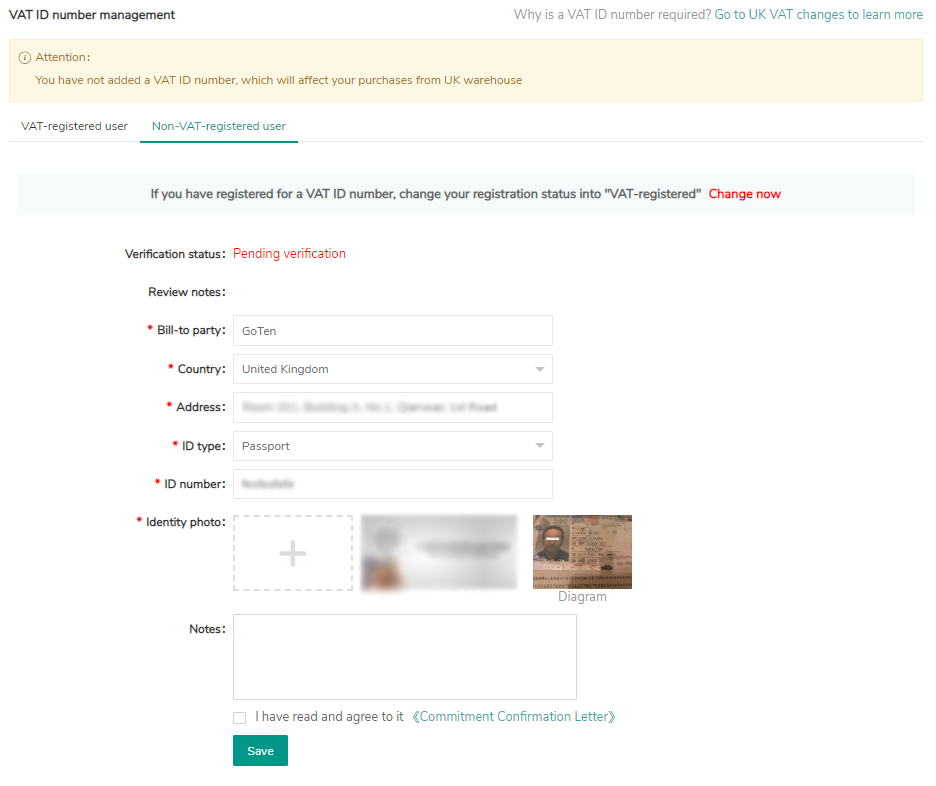

3. Guidelines for Non-VAT-registered users

(1) Go to “My SaleYee”- “Account”- “VAT ID number management”

(2) Click“Non-VAT-registered user”-“Add VAT information” to fill in related information as required

(3) After clicking the "Save" button, the information you've just submitted will be "Pending verification" under the tab of "Non-VAT-registered user";

*Please note that the identity information should be consistent with the bill-to party.

(4) Please note that there are three verification statuses: Pass, Fail, Pending verification. If the status shows "Fail," you need to edit and submit the information again.

*Non-VAT-registered users can change their registration status into "VAT-registered" by clicking "Change now."

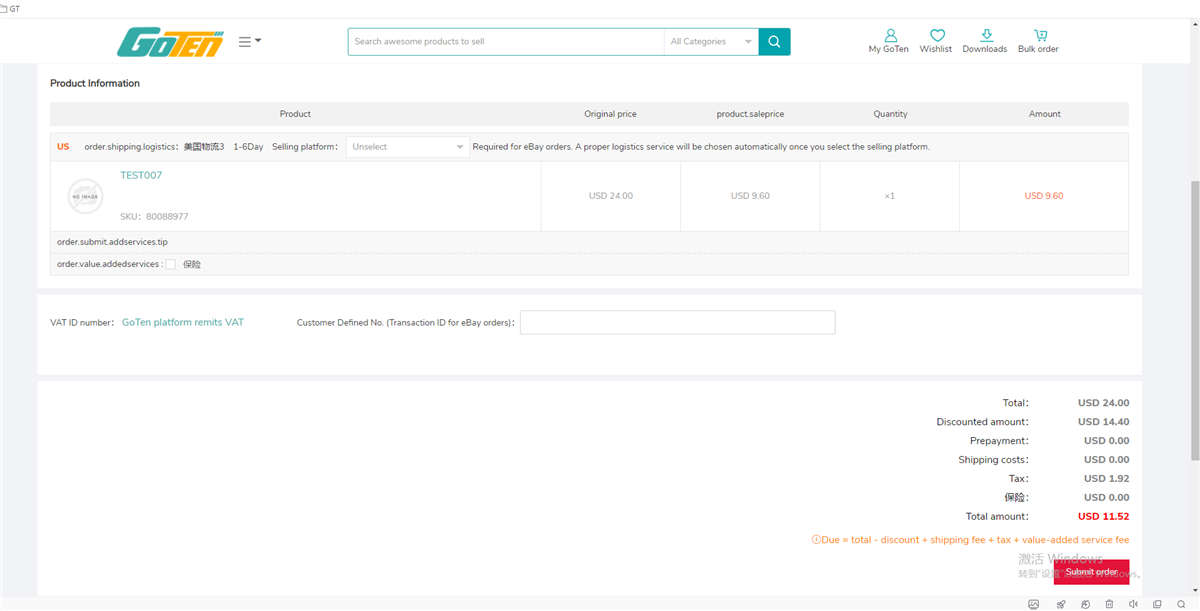

4. Guidelines for Different Methods on Placing Orders

(1) Use Shopping Cart

After adding a product to cart, go to your shopping cart, and proceed to checkout. For purchasing products delivered to countries that levy VAT:

① VAT-registered users who have added VAT ID numbers on SaleYee can select the corresponding VAT ID number to successfully submit the order;

② Non-VAT-registered users who have added VAT-related information on SaleYee can directly submit the order;

③ Users who have not added VAT-related information on SaleYee cannot place orders, and you can click "add" button to fill in the related information.

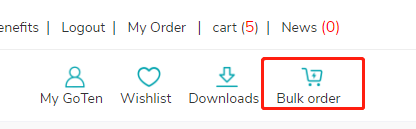

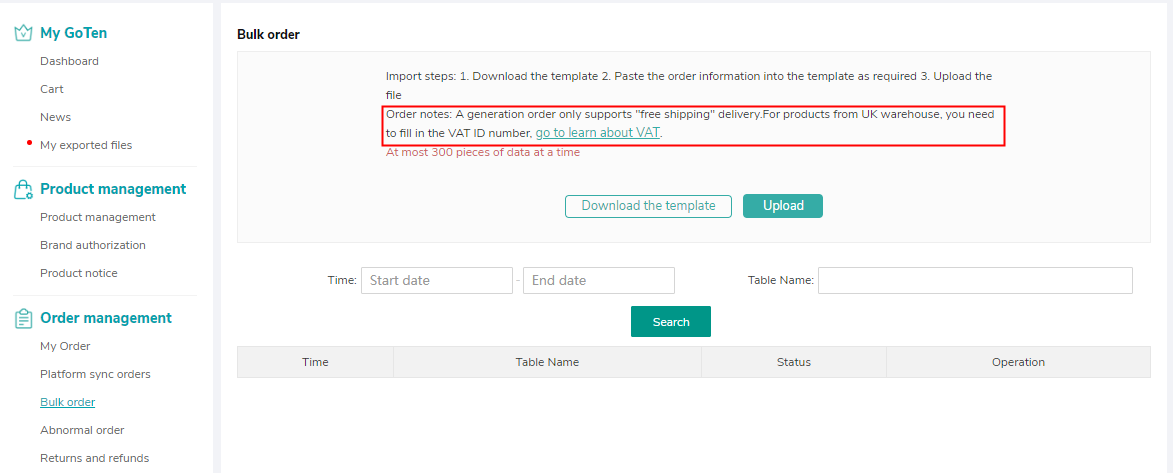

(2). Bulk Orders

1. Go to “Bulk order” ;

(2) You will be noticed to add VAT related information;

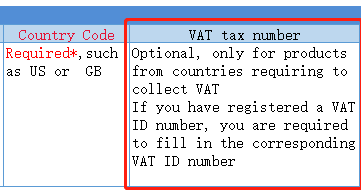

3. Click "Download the template" and you can find that "VAT tax number" has been added.

To get products delivered to countries that levy VAT:

① VAT-registered users who have added VAT ID numbers on SaleYee can fill in the corresponding VAT ID number in the form;

② Non-VAT-registered users who have added VAT-related information can leave a blank here in the form;

③ Users who have not added VAT-related information on SaleYee cannot bulk order.

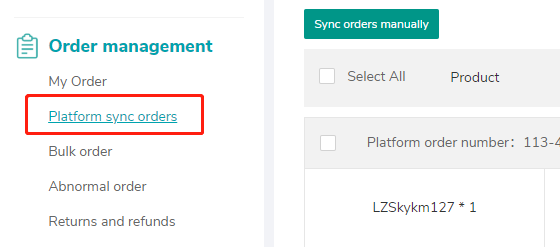

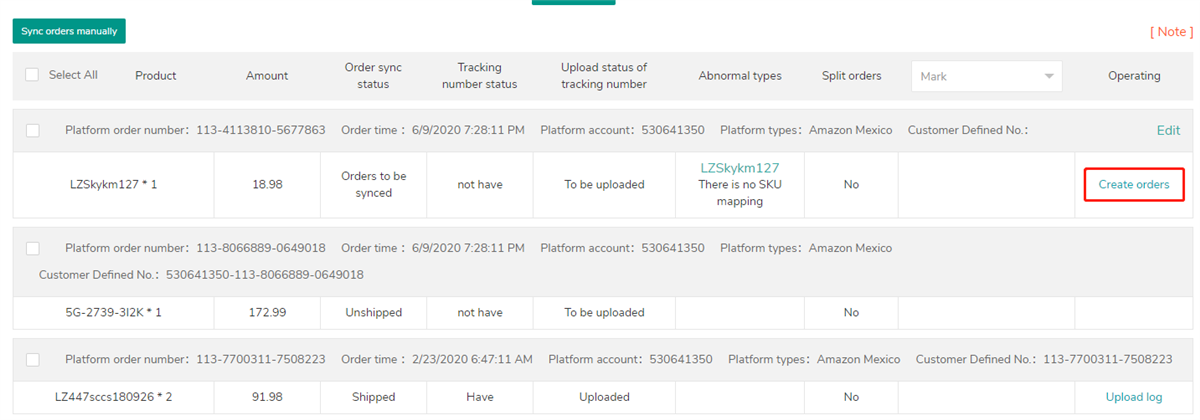

(3). Platform Sync Orders

1. Go to “My SaleYee” - “Order Management”- “Platform sync orders”;

2. For orders delivered to countries that levy VAT, click "Create order" button one by one;

3. On the pop-up window:

If reminded "You have not added VAT related information," you can click "Add now" and fill in the related information as either a "VAT-registered user" or "Non-VAT-registered user."

① VAT-registered users can select the corresponding "VAT ID number" added previously on SaleYee to generate an order;

② Non-VAT-registered users who have added related information can also directly click "Create order";

(4) Order via API

1. Users who have not added VAT related information can go to "VAT ID number management" to fill in the related information as either a "VAT-registered user" or "Non-VAT-registered user" and then can place orders via API. (VAT-registered users can set the default VAT ID number for automatically sync to API);

2. For orders delivered to countries that levy VAT:

① For VAT-registered users, the default VAT ID number is required so that orders will correspond with the default VAT ID number via API;

② For non-VAT-registered users who have added related information, the corresponding VAT amount of orders synced via API will be collected and remitted by SaleYee;

③ Users who have not added VAT-related information cannot use API to place orders.

* Users who order via API should set up/modify access points to successfully place orders. Please contact your account manager and ask for "API docking document."

5. FAQs

Non-VAT-registered, do I need to provide any information?

Whether you haven't registered for VAT or aren't required to register for it, to get products delivered to UK addresses, you'll need to fill in related information so that SaleYee can collect and remit the applicable VAT amount to relevant authorities. In this case, non-VAT-registered users must provide information as follow: ① Bill to party; ② Country; ③ Address; ④ Certificate type; ⑤ ID number; ⑥ Identity photo.

How long will the verification take?

SaleYee's team will check the information you submit as soon as possible. Please submit related information right away to avoid any problems that might occur due to late submission!

Will the requirement affect ordering in bulk?

Users who have not added VAT-related information on SaleYee cannot bulk order. The field "VAT tax number" has been added to the template for you to place orders in bulk. To get products delivered to countries that levy VAT: ① VAT-registered users who have added VAT ID numbers on SaleYee can fill in the corresponding VAT ID number in the form; ② Non-VAT-registered users who have added VAT-related information on can leave a blank here in the form.

What if I get orders forwarded from my online store?

|

|

|

To proceed with checkout and complete the purchases: 1. Go to "My SaleYee" - "Order Management"- "Platform sync orders"; 2.For orders delivered to countries that levy VAT, click the "Create order" button one by one; 3.On the pop-up window: If reminded "You have not added VAT related information," you can click "Add now" and fill in the related information as either a "VAT-registered user" or "Non-VAT-registered user." ① VAT-registered users can select the corresponding "VAT ID number" added previously on SaleYee to generate an order; ② Non-VAT-registered users who have added related information can also directly click "Create order." |

Can I add multiple VAT ID numbers?

Of course. You'll be asked to select the corresponding VAT ID each time at checkout when you use the shopping cart or process orders synced from third-party platforms. When using the bulk order template, you need to fill in the correct "VAT tax number" for orders delivered to UK addresses. However, if your orders are synced via API, setting the default VAT ID number is required.